How Virtual Cfo In Vancouver can Save You Time, Stress, and Money.

Wiki Article

Getting My Cfo Company Vancouver To Work

Table of ContentsVirtual Cfo In Vancouver - An OverviewThe Best Guide To Vancouver Accounting FirmThings about Small Business Accounting Service In VancouverIndicators on Vancouver Accounting Firm You Need To KnowHow Vancouver Tax Accounting Company can Save You Time, Stress, and Money.Tax Accountant In Vancouver, Bc Can Be Fun For Anyone

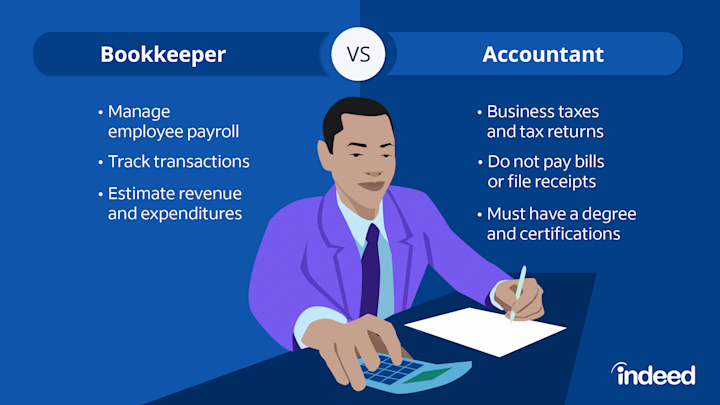

Below are some benefits to employing an accountant over a bookkeeper: An accounting professional can provide you a thorough sight of your service's economic state, in addition to approaches and also suggestions for making financial decisions. Bookkeepers are only responsible for videotaping economic transactions. Accountants are required to complete even more education, certifications and job experience than bookkeepers.

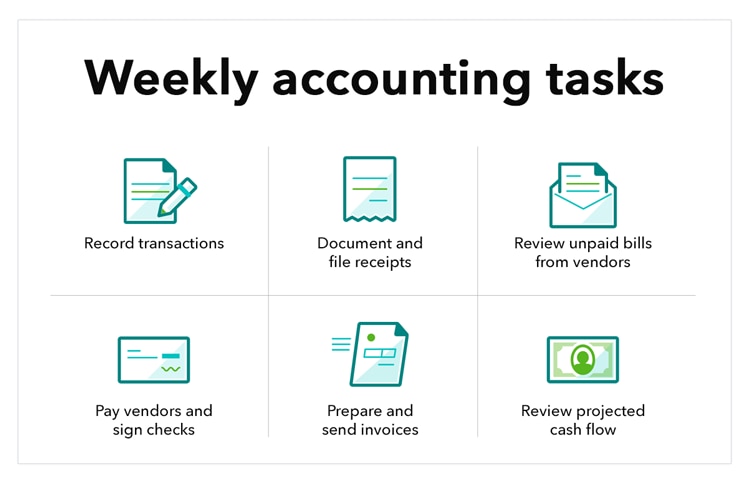

It can be hard to determine the suitable time to employ an audit professional or bookkeeper or to determine if you require one at all. While several small businesses work with an accountant as a consultant, you have numerous choices for managing financial tasks. Some small organization proprietors do their own bookkeeping on software their accountant recommends or uses, offering it to the accounting professional on a regular, regular monthly or quarterly basis for activity.

It might take some history research to locate an appropriate accountant because, unlike accountants, they are not required to hold a professional qualification. A strong recommendation from a trusted coworker or years of experience are vital variables when hiring a bookkeeper.

How Pivot Advantage Accounting And Advisory Inc. In Vancouver can Save You Time, Stress, and Money.

For small companies, adept cash administration is a critical aspect of survival and also development, so it's a good idea to collaborate with an economic specialist from the beginning. If you like to go it alone, think about beginning out with accountancy software application and keeping your books meticulously up to date. That means, should you require to employ an expert down the line, they will have exposure into the full monetary history of your company.

Some source meetings were conducted for a previous version of this write-up.

How Small Business Accounting Service In Vancouver can Save You Time, Stress, and Money.

When it involves the ins and outs of tax obligations, bookkeeping and money, nonetheless, it never hurts to have an experienced professional to resort to for guidance. An expanding variety of accountants are additionally taking treatment of things such as capital estimates, invoicing and HR. Inevitably, several of them are handling CFO-like roles.Small company owners can anticipate their accounting professionals to help with: Picking the service framework that's right for you is necessary. It affects just how much you pay in tax obligations, the documentation you require to submit and your personal liability. If you're aiming to transform to a different business framework, it might lead to tax obligation effects and various other problems.

Even business that are the exact same size as well as sector pay very various amounts for audit. These prices do not transform into cash money, they are required for running your organization.

Not known Details About Virtual Cfo In Vancouver

The average expense of audit solutions for small company differs for each and every distinct circumstance. However given that accountants do less-involved tasks, their prices are frequently more affordable than accountants. Your monetary solution cost relies on the work you require to be done. The typical regular monthly bookkeeping costs for a small company will certainly climb as you outsourced CFO services include a lot more solutions as well as the jobs obtain more difficult.For instance, you can videotape deals as well as procedure payroll making use of on the internet software program. You go into amounts into the software, and also the program computes total amounts for you. In some situations, payroll software application for accountants enables your accountant to offer pay-roll processing for you at very little additional expense. Software services come in all shapes and also sizes.

The Best Guide To Small Business Accountant Vancouver

If you're a brand-new organization owner, do not fail to remember to element bookkeeping costs into your budget plan. If you're a professional proprietor, it might be time to re-evaluate audit prices. Administrative expenses and also accounting professional costs aren't the only accountancy costs. small business accountant Vancouver. You should additionally take into consideration the effects audit will certainly carry you and also your time.Your time is also important and also must be considered when looking at bookkeeping costs. The time spent on accounting jobs does not generate earnings.

This is not planned as legal suggestions; to find out more, please visit this site..

How Tax Consultant Vancouver can Save You Time, Stress, and Money.

Report this wiki page